About the BS in Accounting Degree

Why Study Accounting at Cedarville?

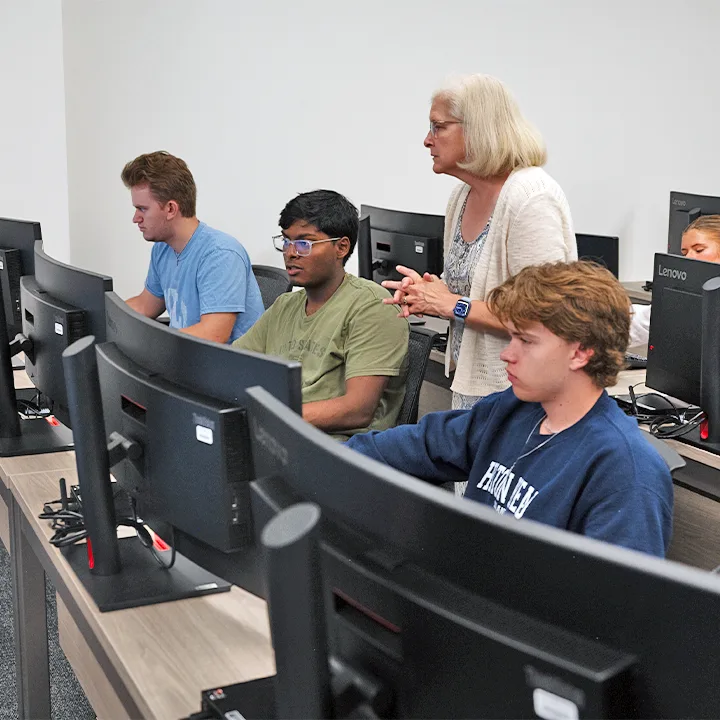

Unlock your path to a rewarding career in public or corporate accounting with Cedarville's distinctly Christian accounting program. Designed to empower you for professional success, this program goes beyond preparing you for a job. You'll learn how to make a Gospel impact through your vocation, no matter where God leads you.

Accounting is often referred to as "the language of business" because accountants communicate complex financial information to business decision-makers. You'll learn to analyze past activities, forecast future operations, measure performance, track expenses, and provide internal controls to prevent fraud or theft. Beyond equipping you with these essential skills, the program encourages you to lead through service and glorify God with your integrity in the workplace. You'll graduate ready to make an impact in the business world.

Request Info VisitComplete Your Accounting Degree Online!

Interested in accounting but need added flexibility? Connect to Cedarville from wherever you are! This program is also offered online, with six start times throughout the year.

Explore Cedarville OnlineWhat Sets Cedarville Apart?

-

Biblical Worldview

The Bible is the authority for research and study in every class you'll take. -

Mentoring Christian Faculty

You'll be taught by highly-credentialed professors who want you to succeed. -

Top Placement Rates

Our graduates achieve top career and grad school placement rates — 10% above the national average.

Program Overview

Program Format and Related Programs

Cedarville offers graduate and undergraduate programs with flexible completion options. You may also want to consider these related programs as you choose the degree or program that is the best fit for you.

Related Programs

Program Level and Format

- Undergraduate

- 4-Year

- Residential

Program Faculty

Program News

-

Increasing Access and Affordability: Cedarville Expands Online Degree Programs

Cedarville launched online undergrad programs in 2025 (accounting, communication, finance, IT management, management). Strong enrollment is fueling expansion into fully online, biblically integrated degrees in psychology, education and Bible starting fall 2026. -

Aiming True, Living Fully: Gracen Fletcher is Following Her Dreams

Gracen Fletcher, a farm girl turned elite archer, balances Olympic-level training with online studies at Cedarville University, living out her faith while pursuing excellence in both sport and academics.